Pipeline Equities

PO Box 571977

Houston, Texas 77257

Phone: 713-623-0690

Pipeline Recovery

excavation & removal

Damage Assessment

of easements

Pipeline Appraisal

pipeline property valuation

Pipeline Equities

PO Box 571977

Houston, Texas 77257

Phone: 713-623-0690

excavation & removal

of easements

pipeline property valuation

The idea of excavating a pipeline that was laid seventy-five years ago is beyond understanding or at least very questionable for those not acquainted with the industry. Most only speak of this type of undertaking as a scrap commodity and thus have no understanding of other values this product might have. Like many other disciplines and industries, the answer lies in knowing what you are doing, and taking the guesswork out of the equation.

The standard formula for determining the overall value of a pipeline that has throughput uses the net operating income (NOI) multiplied by a time life number. For example:

$450,000 X 10 years = $4,500,000.00

An alternative to this type of valuation is the “Replacement Cost New” method that is simply the replacement cost of the pipeline based on today’s cost depreciated to reflect the age of the subject pipeline property. This method takes into account the construction and acquisition costs associated with a replacing the old pipeline with a completely new pipeline. There are circumstances when, due to demand and scarcity, an easement, corridor, or right of way might be worth more than the 70 or 80 year-old pipeline that lies in it.

Salvage value determinants are variable depending on the market. Almost all steel related markets are weighted by the price of scrap at one time or another. One barometer for determining the value of good used pipe is by giving it worth based on 70% of the price of new similar pipe. This is the highest price for used pipe and is normally the price to an end user.

There are several layers of wholesale between that end user and the salvage operator on the track hoe on a right of way somewhere in New Mexico. Between the two is the hauling, grading, straightening, cleaning, beveling, cutting, loading, trucking and selling of the pipe. Often an entire line might be sold to one distributor who then resells in truckload quantities to others who might sell by the piece. Each level of sale has a different price for a unique utility, and each level has a specific type of buyer. This is the nature and make-up of the structural steel industry.

At the very core, pipe from the pipeline is just a tubular form of steel and is used in the same manner as that commodity. The goal is to get as high up the sales chain as possible in order to get the most for your product. We usually never deal with end users at the 70% price level, but instead try to get the 50% level leaving 20% for distributors who deliver to end users and deal with credit, collections, warranties, and other problems associated with dealing with customers at the retail level.

Most pipelines excavated for structural purposes are measured by weight on a per ton basis. There are millions of feet of vintage pipeline in the U. S. of 8 5/8″ diameter and of a construction method called “lap weld” which is like a butt weld type construction. Lap welding starts with a sheet of steel that is rolled into a tubular shape and welded at the point where the ends come together or “lap”. Almost all of the pipe laid in the 1920’s and 1930’s for oil transportation was of lap weld construction, and almost all of this pipe uniformly had a 0.322″ wall thickness. This type of pipe weighed 28.55 lb/ft and was called “standard wall” as this was the standard wall thickness for line pipe used in the transportation of oil. The joints were usually 20′ long as this was the length that fit easily on the mule-pulled wagons that distributed this pipe along the right of way.

If the price of scrap for “iron” as scrap dealers term it (pieces of pipe longer than three feet long), was $200 per ton for example, then that meant the standard wall pipe was worth $0.10 per pound ($0.10 x 2000 = $200). The 28.55 lb/ft standard wall pipe was worth $2.85 per foot at a minimum as that was what it would bring as scrap after you hauled it to the scrap yard. In any case the scrap establishes the minimum worth, and the price of new pipe at the mill represents the opposite end of the spectrum. This mill price might be $900 per ton ($0.45 per pound). If they were the exact same product (which they are not) then the new pipe is worth $12.85 per foot ($0.45 x 28.55).

PRICE COMPARISONS | ||

| Price | Used | New (Equivalent) |

| Price Per Ton | $200 | $900 |

| Price Per Pound | $0.10 | $0.45 |

| Price Per Foot of 28.55lb/ft Pipe | $2.85 | $12.85 |

So for estimating purposes we can say the new price is $12.85 per foot, and the scrap price is $2.85 per foot. Somewhere in this range is a value for reuse for structural purpose. Also take into account the value added at different stages going up the sales chain. One wholesaler might cut the pipe in ten foot lengths and bevel or end finish each end of the pipe. Another shop might weld on a length to a 20′ length to make it a 35′ joint for use in a particular piling job that requires that length. The customizations are as varied as the types of usage. Other structural uses might be for corrals, fence posts, flag poles, bridge railings, cattle guards, or even re-use as a pipeline or driven as pile for strengthening supports. One yard in Oklahoma uses 22″ diameter line pipe by splitting it longitudinally and welding plate on the sides to make feed troughs for cattle feed lots. They have satisfied a healthy demand for many years for this product. All of these items are worth what they will bring based on price, condition, demand, and availability. They are all worth a great deal more than scrap, but to a pipeliner, they may be seen only as scrap.

To factor in net value, it is necessary to factor in the following costs among several costs related to pipe removal:

ADDITIONAL COSTS | |

| Additional Cost Factor | Approximate Cost (per foot) |

| Purchase of pipe from owner | $0.35 |

| Excacation | $1.90 |

| Hauling | $0.15 |

| Landowner compensation | $0.20 |

The above table is an overview of additional costs to factor into the net value of used pipe in today’s market. These costs come to $2.60 per foot, which is very close to break even at scrap values, if scrap prices were that high. There are lots of variables, but scrap is only a back up in case all else fails and there is no structural market. It is very important to note that a non-qualified track hoe operator can make scrap out of the best pipe ever laid. If he is not careful, he can ding, dent, scrape and bow any pipe into junkyard iron.

This is a long explanation to determine value, however you might consider a short cut method to give you a rough estimate of used pipe value:

(Sell Price – Costs) x Line Length x 90%

If you know you can sell the used pipe for $400 per ton ($0.20 per pound, $5.71 per foot), subtract the take-up and cleaning costs, then the pipe might be worth a net of $2.25 per foot. Multiply by the length of the line and subtract 10% for losses and damaged pipe to come up with approximately $2 per foot value of the vintage pipe after removal.

It is important to mention costs of transportation. As of the date of this writing (June 2010), trucking costs to bring pipe to Houston to be cleaned, straightened, cut, re-welded or worked in any way for the purpose of exporting through the Port of Houston is about $1.75 per loaded mile. Rates can vary from $1.50 to $2.25 per loaded mile.

In the course of due diligence, it is necessary to survey the pipeline by riding the length of it and looking for unforeseen hazards like lakes, rivers, expensive crops, marshland, wildlife refuge areas, other environmentally sensitive areas, and encroachments of all kinds. Often, you will find a home, barn or a trailer erected over the right of way which will have to be dealt with.

Some encroachment issues are more serious than others.

It is then important to have a qualified operator dig a bell hole over one section of the pipe to 1.) Confirm the pipe is there, and the depth it is buried and 2.) Verify the size, and determine the condition.

This confirmation and verification should be done by a qualified inspector. During the inspection, a sample of the coating can be examined to determine its composition. This part of the investigation is particularly important as asbestos presence can have an impact on costs of removal of the pipe and disposal of the residue of asbestos containing materials. See Figure 3.

Inside a bell hole, this inspector is checking exterior, wall thickness, and coating as well

as depth of pipe and soil conditions.

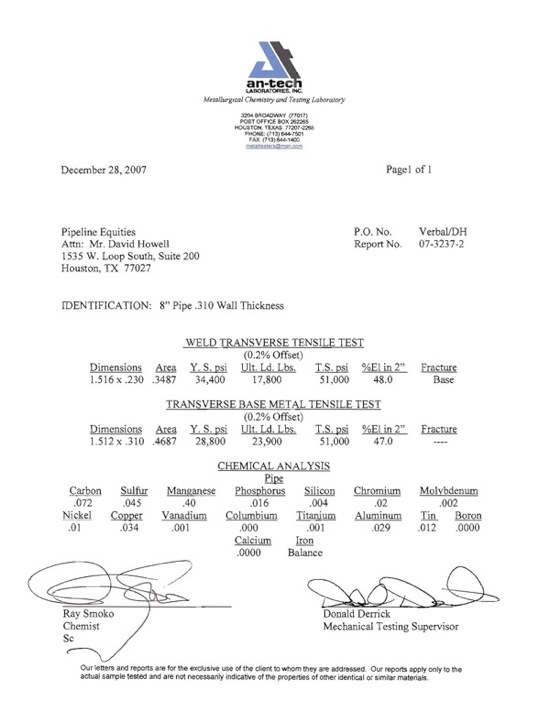

Checking the pipe for the type and quality of the steel is an important factor in determining the integrity of the pipe in question. The best way to do this is to cut a section or coupon of the pipe and send it to a lab for testing for yield or burst in PSI as well as tensile or hardness in PSI. Additional tests can be done in metallurgical laboratories to determine the various chemical elements inherent in the steel.

Lab report on metallurgy of steel in pipe sample – click to download PDF

There are several factors in determining value of vintage pipelines. You really don’t know what is there or not there until you look or investigate in various ways. A lot can happen in 60 to 80 years, especially one to five feet underground.

The goal is to keep the pipe above the scrap value and sell it into the structural market. The most destruction of good structural grade steel pipe results from contractors or equipment operators who do not understand the value of this product and treat it as junk. And junk it becomes at the hands of the uninformed. At that point, it has value only for what it will bring at the local scrap yard.

Lack of experience and training leads to piles of junk ready for the local scrap yard.

Fill out the short form below to receive our Pipeline Recovery Manual.

Sign up for our free newsletter to receive your complimentary copy of our Pipeline Recovery Manual that explains our entire process for recovering or salvaging idled or abandoned pipelines.

You will see how we deal with landowners regarding notification and recordings. How to draft a contract of sale with models by: Exxon, Texaco, Koch and others and pictures showing actual work in process.

The manual shows Pipeline Equities job references, right of way releases, agreements and the history and background of Pipeline Equities and managing partner David Howell. These references touch on parts of the six million feet of line removed or handled by the company over the past twenty years.

A line pipe table describing various weights, grades, and pressure ratings of ERW and seamless line pipe is included. This section is an indispensable tool for anyone doing operational word with line pipe.

Also included are extensive glossaries of pipe, pipeline, and right of way terms.

Request a complimentary Pipeline Appraisal Handbook

Fill out this short form and you will be sent a confirmation link to our Newsletter. Once you click the link you will be subscribed to our newsletter and taken to a page where you can download the Pipeline Appraisal Handbook.

This handbook written by David Howell, managing partner of Pipeline Equities is the basic text of any pipeline valuation. All of the essential factors for establishing the value of a pipeline are discussed along with exclusive proprietary formulas and tables essential to a certified appraisal.

Also included are 32 pages of pipe weight and grades tables that cover virtually any situation which might be encountered regarding line pipe requirements. Additionally you’ll find an extensive glossary of pipe, pipeline and right of way terminology is part of the Handbook.

Subjects include: Replacement, Right of Way, Surface Inventory, Throughput, Salvage/Recovery, and comparable sales histories to name a few of the basic factors of pipeline appraisal.

The author recognized a need for a report or “how to” manual for properly appraising pipelines and pipeline right of ways. Currently the work is being done by accounting firms, engineers, and real estate appraisers.

Howell has forty-five years experience in many sectors of the petroleum industry from drilling contractor and oil and gas operator to pipe and supply distribution throughout the world. He has published Tradex Equipment magazine, the Whole World Oil Directory, and the Texas Oil Register.

For the past twenty years, Howell has been almost exclusively engaged in pipeline sales and acquisition, appraisal, removal for salvage, environmental remediation and general pipeline operations.

Howell currently serves on board of the Pipeline Appraisal Institute and is a member of the International Right of Way Association. Howell is a graduate of Texas A&M University – Kingsville and a native of Alice, Texas. He is currently residing in Houston and is the managing partner of Pipeline Equities.