The appraisal of pipelines is a niche industry, requiring specialized methods to properly determine valuation. These methods combine both a pipe liner’s view of the pipe and the right-of-way in which it rests as well as traditional appraisal or asset valuation methodology.

Most appraisals, even regarding pipelines, are real estate appraisals. Trained easement or real estate appraisers essentially measure the value of a pipeline according to the value of the right-of-way. This value in turn is based on the value of neighboring land. Though important, however, this is a small part of the overall picture when appraising a pipeline.

Appraisals known as asset valuations establish value for a piece of property, inventory, or business and are more easily adjusted to accurately reflect the needs of the petroleum pipeline industry. The need for pipeline-specific appraisals emerged following discovery of the overvaluation of pipelines by local taxing authorities as well as overvaluation and undervaluation of pipelines in mergers, acquisitions, and estate settlements.

Valuation reports concerning active or inactive petroleum pipelines may be needed for pipeline purchases or sales, estate settlements, termination of partnerships and division of assets, determining salvage value, readjusting local jurisdictional taxes, and establishing value for general accounting purposes. The general methods of appraisal for pipelines have some real estate methods in common such as comparative sales analysis, cash flow, and replacement cost, but others unique to the pipeline industry.

Case Study

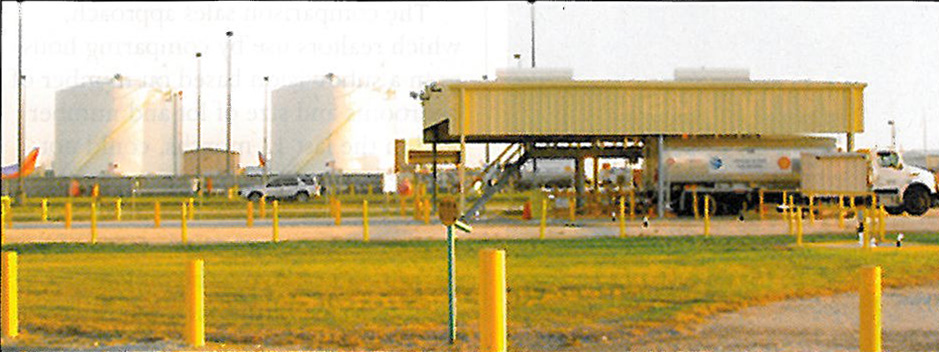

A customer had a contract to supply jet fuel via pipeline to a municipal airport being supplied by tanker. It planned to lay a 6-mile pipeline from a refinery source of jet fuel to an airport to replace daily trucking. The new line was to go to a new fuel tank terminal built at the airport (Fig. 1). From the storage facility, trucks would transport fuel directly to planes for refueling (Fig. 2).

Fig. 1 – A new 6-mile pipeline supplies jet fuel to the new fuel tank terminal at a municipal airport in the appraisal described in this article.

The customer’s bank agent said construction would be ready to start shortly and the bank needed an appraisal to satisfy their requirements for a pipeline construction loan. The appraisal was to be made based on the plans of the yet-to-be-built pipeline. All parties agreed, settled on a fee, and signed a letter of engagement. The letter explained that the appraisal company would be working for the bank, and the bank, rather than the pipeline company client, would be responsible for payment and expenses.

The appraisal company collected plans for the pipeline along with other documents regarding financial information for the project. It also obtained blueprints for building the pipeline, right-of-way contract documents, a contract to buy the product (in this case jet fuel from a refinery), and a contract to sell the product, in this case at a municipal airport.

A meeting with the principal of the pipeline company client who had put the deal together followed review of these documents. Over the course of a meeting lasting a few hours, the appraiser requested any data about the project as well as personal information about the principal. The principal provided a comprehensive resume of his experience in the pipeline industry, later verified through others who had worked with him and knew his management style and abilities.

The meeting then moved to the contracts section. The appraiser was interested in the demand side and how revenue would flow. The purchase contracts showed a 10-year agreement with the airport to supply jet fuel from the pipeline company with an escalation clause and renewal opportunity at the end of term. The bank loan would be repaid in 3 years under the existing cash flow proposal. The airport and its municipal owner would save 32% vs. trucking rates.

A survey trip to the site allowed photographs of the source, the right-of- way, and the terminal area where the city had built fuel storage tanks in anticipation of the pipeline construction at the airport terminal. Aerial photographs of the route and driving the easement in a four-wheeler prOVided additional perspectives. The contractor had produced alignment sheets showing the exact path of the pipeline. The client had mapped the right-of-way away from heavily congested areas like schools and subdivisions to avoid the sort of controversy that can kill or delay projects indefinitely.

Regular shipments of 30-40 tanker trucks per day were supplying jet fuel to the airport, and the client had seen economics existed to build a profitable pipeline and provide a reliable source of transportation while saving a considerable amount of money for the city’s airport. Two refineries side-by-side and only 6 miles away from the market assured the source of supply. The pipeline company had secured contracts to buy jet fuel in equal quantities from both suppliers. On the demand side, airport traffic was growing, and the surrounding area had a good base of growing customers from tourism as well as government and private industry. The client had secured a 10-year contract to supply the airport with needed jet fuel.

Fig. 2 – From the on site storage facility the jet fuel is transported by truck directly to the aircraft. Trucks used to transport the fuel between the refinery and the airport as well.

Demographics looked good as the airport and the area it served had a history of sustained growth. The management team in the front office and the field looked good. The operations plan was unique in the way it was outsourced for the sake of economics and simply because a large company-based staff was not necessary. The pipeline company principal was interested in building the pipeline as economically as possible to payoff the loan quickly.

This pipeline client had found a niche market in an under-served segment larger pipeline companies had not chosen to pursue due to its scale. But this pipeliner could own a pipeline free-and-clear and his bank could get its money back in a 3-year period. Completing the appraisal and delivering several hard copies to the bank and the client preceded quick loan approval. The pipeline is now complete and operational.

Appraisal Methods

The primary method of appraisal was the construction cost, new or replacement cost approach. This method is based on the cost (amount spent to construct or improve) of building a new or similar pipeline using the same materials and the same methods and amounts for payment of easements, damages and construction, etc. This approach can also work back to depreciate new replacement cost on an annual basis projected to the life of the pipeline to determine the value of a vintage pipeline in today’s market. Depreciation or devaluing of this pipeline was not necessary, the current value as a new entity instead being sought. The total amount calculated for the cost of new construction accounted for about 50% of the pipeline’s determined value.

The appraiser also applied a variation of the real estate income capitalization, approach by which the annual income stream based on gross revenue net of operating expense is multiplied by factors of 5′ to 12 depending on potential for revenue increases through tariff or volume additions. This method also works in valuing oil and gas royalties or mineral interests.

Many correlations exist between the value of a pipeline in the ground and mineral interests. Pipelines have an indefinite life and seemingly new applications are being introduced for their use just as technology continues to expand and enhance the value of mineral interests.

If revenue produced is $100,000 1 year after operating expense, this appraisal approach would calculate 5 to 12 times this number and weigh it in as 50% of the overall value. The degree of multiplier depends on the value of the factors used and their weight.

The comparison sales approach, which realtors use by comparing houses in a subdivision based on number of bedrooms and size of lot and number sold in the last 12 months, could not be used. Nor could real estate acreage sales. The real estate factor in easements is generally not more than 5-7% of the overall cost of laying the pipeline.

Book value of the asset by the seller is only important to the seller. It is not a viable approach or method to determine or assign value. Even though a potential purchaser would care less at what value the seller carried the asset on his book, the book value could have a bearing on the seller and his willingness to sell.

Highest and best use is a principle with its roots in real estate and wants to state simply that a parking lot might be best used for a strip shopping center instead. The best use for a pipeline might be a variation of pipeline usage by converting it to electric cable conduit, water or sewage transportation, or reversing Dow as an oil, product, or gas transmission line, or increasing it’s size and utility via replacement. It, however, remains a pipeline.

Value Factors

The pipeline appraisal industry uses more than 40 different factors for determining value in a pipeline beyond the basic appraisal approach methods. These subdivisions of appraisal range from pipe WT and the date of its installation to the types of chemicals being transported. Factors used in calculating the value of the jet fuel pipeline included:

- Availability of supply and multiple suppliers. With two refineries side-by-side the pipeline company could take equal amounts from each or increase from one or the other in times of higher demand or in case of unforeseen occurrences, a factor in appraising the pipeline’s value. The proximity of supply was also important, the refineries being only 6 miles away.

- Contracts on the purchase side for 10 years and on the sales side for the same period locked in value.

- Management in the front office and field office showed experience, flexibility, and economy in their approach to problem solving.

- Demand. Steady growth had occurred historically, and demographics showed the promise of continued and steady future growth in the areas of industrial, governmental and tourist driven demand.

- The terrain, geography, and weather in the construction area added to the value, the climate being mild and mostly sunny with low rainfall. The pipeline was to be constructed along existing highway and railroad corridors at minimal right-of-way acquisition costs.

- Product volume transported is also an appraisal method (income) bearing consideration.

- Financing methods and terms stood as positive factors in this case.

- The uniqueness of the product transported (jet fuel) discouraged competition.

- High-strength but compact 6.625-in. OD pipe was economical while at the same time accommodating long-term growth in volumes. The appraisal company spent 2 days on site and 67 hrs interviewing participants, reading contracts, interpreting notes. studying photographs and maps, reviewing demographic information, and writing the report.